Prerequisites for setting up a Company:

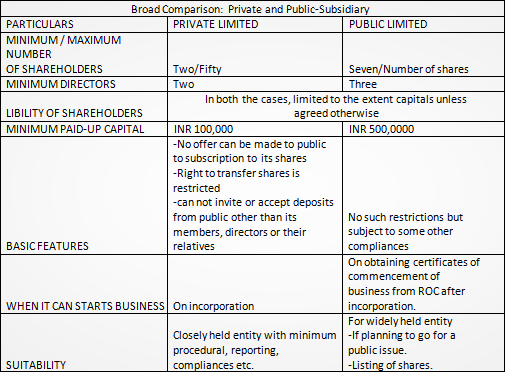

- Minimum paid up share capital of Rs. 100,000 (Rs. One lacs only) for Private Limited company and 500,000 (Rs. Five Lacs Only) for Limited Company, except if require some key words e.g. India, Corporation, Bharat, Industry etc..

- A minimum number of 2 (two) shareholders/ subscribers to Memorandum of Association for Private Limited Company and Three for Limited Company. For a company which is a wholly owned subsidiary of a Foreign Company, both the subscribers should be the bodies corporate. Any private limited company incorporated in India would be deemed to be a public company in case the following conditions are satisfied:

- It is a subsidiary of a foreign company, which if incorporated in India would qualify as a public company under the Companies Act; and

- The entire share capital of the Indian company is not held by that foreign company, whether alone or together with one or more foreign companies.

Also, the company law provisions do not enable the share capital being held in the name of individual/s as nominees of the foreign body or bodies corporate owning the share capital of the Indian private limited company. In such a scenario any private limited company incorporated in India would be deemed to be a public company, if the holding Foreign Company qualifies as a public company under the Companies Act, 1956 and it would have to comply with certain additional compliances and restrictions as are applicable to a Public Company in India.

Having two foreign companies as subscribers is necessary in order to avoid the stringent compliance requirements, which would otherwise be applicable to a public limited company. Foreign investing company would be one of the subscribers (the majority subscriber holding 99.99% shares) and some other body corporate (possibly a sister concern of foreign investing company) could be the other subscriber (it need not have a significant shareholding and may hold only .01% shares).

- Director Identification Number (“DIN”): Every director of a company is required to obtain a unique identification number called DIN from Ministry of Corporate Affairs (“MCA”).

- Digital Signature Certificate (“DSC”): The MCA, India launched an e-governance Project in the beginning of year With the implementation of this project e- filing of all the documents with the Registrar of Companies (“RoC”) has been made mandatory using digital signatures with effect from 16 September 2006. Consequently, the person authorized to sign any document under the company law would be required to obtain DSC to digitally sign the same.

The company incorporation is carried out in the following two steps:

Step 1 – Name approval

Submission of application for name availability

- An application is required to be submitted online in Form No. 1A to RoC to ascertain the availability of the name along with filing fee of Rs

- The application should mention at least four names upto a maximum of six 6 names, in order of preference. It is at the discretion of the RoC which of these four they choose to allot. It may be noted that the RoC usually insists that the name of any Indian company should be reflective of the main activities carried on by

- The significance and use of the word ‘(Brand name)’ should be

- Board resolution should be passed by the promoter companies considering following matters:

- authorization of an individual (representative of Promoter Company) to:

- allowing the usage of “Brand name” in the name of Indian company (this will be required to be stated in the board resolution of the promoter company whose name is proposed to be used in the Indian company).

- incorporation of a company in

> sign all documents and to do all acts necessary for the incorporation;

> for subscribing to the Memorandum and Articles of Association of the proposed Indian Company; and

> sign and execute a Power of Attorney for & on behalf of the company in favor of M/s K R A & Co.

- Power of Attorney should be executed in favour of M/s K R A & to act as an authorized representative on behalf of promoters (this would be signed by the individual authorized by the company in the Board resolution).

Please note that Power of Attorney and Board Resolution would be required to be notarized and consularised in the country in which these documents are executed. However, if the country is a member of commonwealth, then there is no requirement for consularisation and the documents would only have to be notarized. Further, if the power of attorney is signed in India by the individuals authorized in the Board resolution, there will be no requirement for notarization and consularisation of the same. In such a case the copy of the passport of the individuals would have to be furnished to the RoC. The RoC may also require the individuals to be personally present in his office (this depends on the official examining the documents and it is possible that this step may not be required).

Approval of name by RoC

The RoC verifies the application and communicates his decision regarding the availability of the name generally by 8-10 working days. The name approval is valid for a period of 30 days and formalities regarding registration should be completed within that period.

Step 2 – Steps for incorporation post name approval

On receipt of name approval from RoC the following steps should be taken for the incorporation of the company:

Drafting of Memorandum of Association (“MoA”) and Articles of Association (“AoA”) of the company:

The draft MoA and AoA should be prepared. MoA and AoA should be printed, divided into paragraphs and numbered consecutively.

Stamping of MoA and AoA

The MoA and AoA should be stamped as per the Indian Stamp Act and at the notified rate as per provisions of Stamp Duty rates of that state in which Proposed Registered Office Lies.

Subscription to MoA and AoA

- The MoA and AoA should be subscribed by at least two persons in case of Private Limited Companies and Three in case of Limited

- Each subscriber should take at least 1 share and shall write opposite to his name the number of shares he

- Each subscriber should also sign and add his address, description and occupation (if any) in the presence of at least one witness who shall likewise add his address, description and occupation, if any.

- It is important to note that the details in the subscribers’ sheet are required to be filled by the subscribers in their own

- MoA and AoA should then be It should be ensured that the date mentioned on MoA and AoA is any date after the date of stamping and not before that date.

- The subscription table of MoA and AoA will then have to be notarized and consularised in the country in which these documents are executed. In case the country is a member of commonwealth, then there is no requirement for consularisation and the documents will only have to be

Stamping of Power of Attorney

Obtain the stamping on duly notarised and consularised Power of Attorney upon receipt in India, as per the Indian Stamp Act or the relevant State Act.

Submission of Documents

Online filing

Within 30 days from the date of intimation of name clearance by the RoC, following documents are required to be filed online with RoC:

- Declaration of compliance in Form 1 duly signed using DSC by a person named in the AoA as a director or manager or secretary of the company.

- Situation of the registered office of the company in Form 18.

- Particulars of Directors, Managers and Secretary in Form 32.

- Duly signed and stamped MoA and AoA of the

- Power of attorney in favour of M/s K R A & Co. to act as an authorized representative on behalf of

- RoC Registeration

All these documents are required to be digitally signed by a Proposed Director of the Company and certified by counter signature of a Practicing Chartered Accountant or a Company Secretary.

Manual Filing:

Following documents shall be further required to be submitted manually with concerned office of RoC after online filing:

- Form 1 (Declaration of Compliance on incorporation of the company) executed on a non- judicial stamp paper of appropriate duty amount.

- Form 18 (Notice of situation of the registered office of the company).

- Form 32 (Particulars of the first Directors of the company).

- Duly executed stamped copy of MoA and AoA.

- Stamped copies of Power of Attorneys in favour of M/s K R A & Co.

- Proof of payment of RoC registration fee e. RoC Challans.

Certificate of Incorporation

The RoC shall verify the documents and suggest modifications wherever required. The authorised person should duly carry out such modifications. The modified documents should be e – filed again. Thereafter, Registrar on being satisfied that all the requirements for the registration of the company as laid down under the Act and rules made there under have been duly complied with shall certify under his hand that company is incorporated and issue a certificate of incorporation to the company.

Compliance with Indian Exchange Control laws

Foreign Direct Investment (“FDI”) up to 100% is allowed under the automatic route in all activities/sectors except certain specified activities/sectors which require prior Foreign Investment Promotion Board (“FIPB”) approval. Following activities/sectors require prior FIPB approval:

- Manufacture of cigars & cigarettes of tobacco and manufactured tobacco substitutes.

- Manufacture of Electronic Aerospace and Defence Equipments of all types.

- Manufacture of items exclusively reserved for Small Scale Sector with more than 24% FDI.

- All proposals in which the foreign collaborator has an existing venture/ tie-up or technology transfer/ trademark agreement in India in the same field (not applicable to proposals for investments made by multinational financial institutions and investment made in IT sector and mining sector for same area/mineral).

- All proposals relating to acquisition of shares in an existing Indian company in the financial services sector and where SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 1997 is attracted.

- All proposals falling outside notified sectoral policy/ caps or under sectors for which FDI is not permitted and/ or whenever any investor choses to make an application to the FIPB and not to avail of the automatic route.

- All proposals requiring an Industrial License.

FDI in sectors/activities to the extent permitted under the automatic route does not require any prior approval either by the Government or Reserve Bank of India (“RBI”). The investors are only required to undertake the following compliances with the RBI relating to the remittance of money as share capital into the Indian subsidiary:

- Within 30 days from the receipt of the consideration, the company issuing the shares is required to submit a report to the RBI, indicating the following:

- Name and address of the foreign investor.

- Date of receipt of the funds and the rupee equivalent of the same.

- Name and address of the authorised dealer (‘banker’) through whom the funds have been received.

- Details of Government approval, if any.

2. Within 30 days from the date of the issue of shares, the following documents are required to be submitted through AD Category – I bank, to the concerned Regional Office of RBI:

- A report in form FC-GPR.

- A certificate from the Company Secretary of the company issuing the shares, certifying that:

>all requirements of the Companies Act have been complied with;

>terms and conditions of the Government approval(s), if any, have been compiled with;

>the company is eligible to issue shares under the foreign exchange regulations; and

>the company has all the original certificates issued by the authorized dealers(bankers) in India evidencing receipt of the consideration in convertible foreign exchange.

- A certificate from the Statutory Auditors of the company issuing the shares or any Chartered Accountant indicating the manner of arriving at the issue price of the shares.